nd sales tax permit

Ad Simplify the sales tax registration process with help from Avalara. North Dakota Sales Tax Application Registration Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to collect.

How To Register For A Sales Tax Permit In North Dakota Taxjar

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

. Contractors Engaged in Retail. This means that if you are considering opening a new business or are beginning to make sales in North Dakota for the. Property Tax Credit for Disabled Veterans.

If You Have Employees - Income Tax Withholding Guidelines and Registration If You Have Employees. This free and secure. A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit.

Registered users will be able to file and. In the state of North. SALES AND USE TAX PERMIT SURETY BOND OFFICE OF STATE TAX COMMISSIONER SFN 59903 Rev.

With the launch of the new website also comes. Homestead Credit for Special Assessments. Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950 Step 2 Enter the purchasers State of origin and State and Use Tax Permit number.

Fill out one form choose your states let Avalara take care of sales tax registration. North Dakota offers one type of permit a Sales and Use Tax Permit. Obtaining your sales tax certificate allows you to do so.

Applying for a sales tax permit is free of charge and once you are granted a permit you do not have to renew it again. Thank you for selecting the State of North Dakota as the home for your new business. The letter should include.

Property Tax Credits for North Dakota Homeowners and Renters. Office of State Tax Commissioner. The topics addressed within this site will assist you.

5-2011 Name of Principal. Under the provisions of the sales and use tax laws of. Ad Sales And Tax Permit Wholesale License Reseller Permit Businesses Registration.

If you currently have or plan to have employees performing services within North. North Dakota has a 5 state Sales Tax get Sellers Permit for general sales but varies depending on the category 5 7 3 and 2. Fill out one form choose your states let Avalara take care of sales tax registration.

Sales And Tax Permit Simple Online Application. Any person having nexus in North Dakota and making taxable sales in or making taxable sales having a destination in North Dakota must obtain a North Dakota sales and use tax permit. The cost of a North Dakota Sales Tax Permit depends on a companys industry geographic service regions and possibly other factors.

The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. There is no fee to register for this permit with the state of North Dakota. If youre already feeling a little.

North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner. This permit will furnish a business with a unique Sales Tax Number. Send the completed form to.

These additional taxes increase the total. Ad Sales And Tax Permit Wholesale License Reseller Permit Businesses Registration. At LicenseSuite we offer affordable North Dakota.

The first step you need to take in order to get a resale certificate is to apply for a North Dakota Sales Tax Permit. A contractor must have a North Dakota sales and use tax permit to execute a Contractors Certificate. Welcome To The New Business Registration Web Site.

Ad Simplify the sales tax registration process with help from Avalara. Sales And Tax Permit Simple Online Application. In North Dakota this sellers permit lets your business buy goods or materials rent property and sell products or services tax free.

To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. This is a sales and use tax exemption and refund for machinery or equipment used to produce coal from a new mine in North Dakota. Sales Tax Exemptions in North Dakota.

Items subject to use taxon the sales and use tax return. When you apply for a sales tax permit youll also apply for a North Dakota Withholding Tax account if your business has employees. In North Dakota most businesses are required to have a sales tax permit.

Apply for a Sales Tax Permit If your business issues. Or file by mail using the North Dakota Application for Income Tax Withholding and Sales and Use Tax Permit. A sales tax permit can be obtained by registering online with the North Dakota Taxpayer Access Point TAP or by mailing in the Sales and Use Tax Permit Application Form.

The exemption for each new mine is limited.

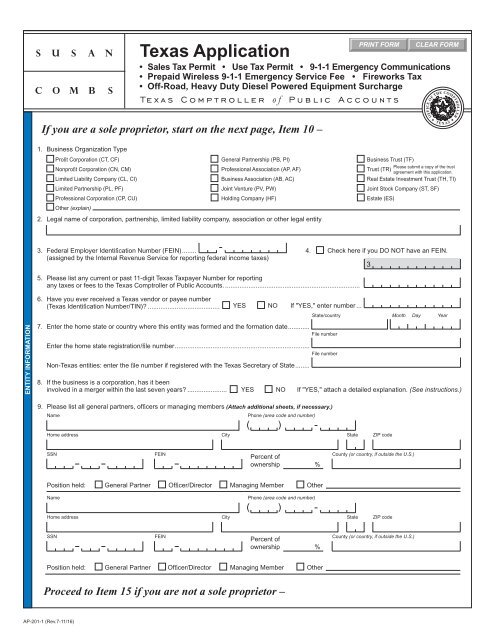

Ap 201 Texas Application For Texas Sales And Use Tax Permit

Instructions On Obtaining A Resale Certificate Sales Tax License

Georgia Seller S Permits Ga Business License Filing Quick Easy

Instructions On Obtaining A Resale Certificate Sales Tax License

Red Lodge Label Nd Tax Permit Red Lodge Label

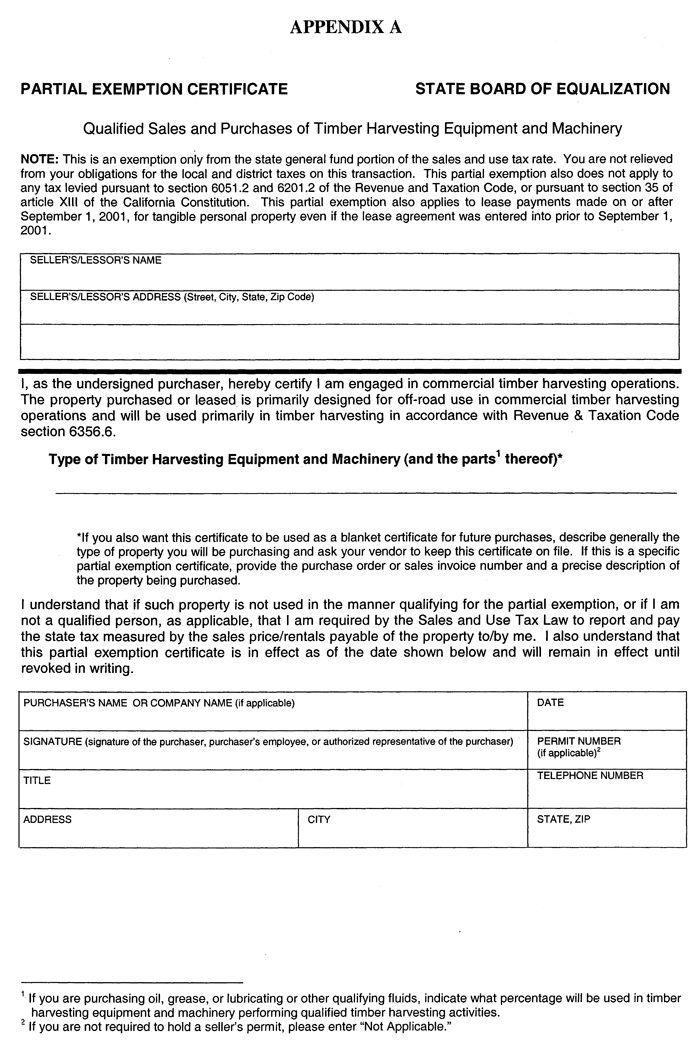

Sales And Use Tax Regulations Article 3

Sales And Use Tax Regulations Article 3

Instructions On Obtaining A Resale Certificate Sales Tax License

Instructions On Obtaining A Resale Certificate Sales Tax License

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

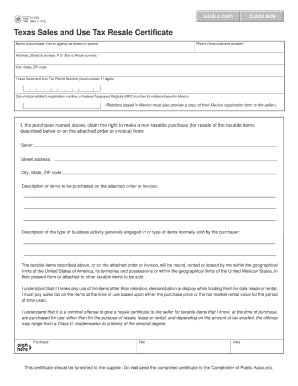

2013 2022 Form Tx Comptroller 01 339 Fill Online Printable Fillable Blank Pdffiller

Form 01 339 Download Fillable Pdf Or Fill Online Texas Sales And Use Tax Resale Certificate Texas Templateroller

Printable North Dakota Sales Tax Exemption Certificates

Printable Missouri Sales Tax Exemption Certificates

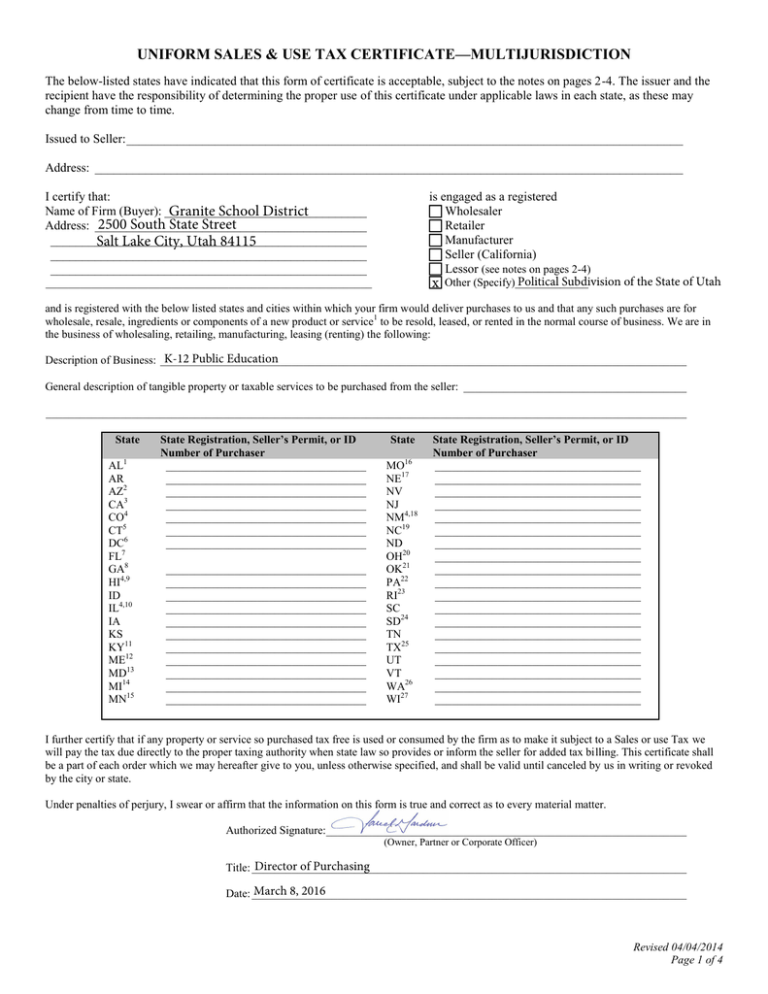

Uniform Sales Amp Use Tax Certificate Multijurisdiction